Discretionary fiscal policy requires action from Congress, so there may be considerable time lags due to debates on the appropriate response, steps in the rulemaking process, and the administrative actions for funds to reach the pockets of consumers. One of the benefits of automatic stabilizers is that they do not require legislative action and respond quickly to economic downturns. How are automatic stabilizers different from changes in discretionary fiscal policy? According to the Congressional Budget Office (CBO), revenues have accounted for about three-quarters, on average, of the effect of automatic stabilizers on the budget over the past 50 years ( CBO 2015). For instance, outlays for unemployment insurance increase when the unemployment rate rises, and spending on anti-poverty programs like Medicaid and SNAP increases during recessions because bad economic times mean that more people are eligible.Īs shown in the chart below, the bulk of the value of automatic stabilizers comes from changes in tax revenues, rather than from spending on programs. Spending on some transfer programs also depends on the state of the economy. For example, personal and corporate income tax collections decline during recessions along with income and profits, and payroll tax collections decline when employment and wages fall. Most taxes have a stabilizing effect because they automatically move with economic growth. What are the components of automatic stabilizers?īoth taxes and spending can have stabilizing effects on the economy. Most automatic stabilizers are federal states and localities are generally required to balance their budgets, so they can’t run big deficits during downturns. When times are better, automatic stabilizers generally phase down or turn off. Additionally, with a decline in income, a household may become eligible for unemployment insurance (UI), food stamps (Supplemental Nutrition Assistance Program, or SNAP), or Medicaid.Īutomatic stabilizers don’t just help families facing financial difficulties-they also help the overall economy by stimulating aggregate demand when times are bad and when the economy is most in need of a boost. For example, when a household’s income declines, it generally owes less in taxes, which helps cushion the blow.

A major advantage of the built in or automatic stabilizers code#

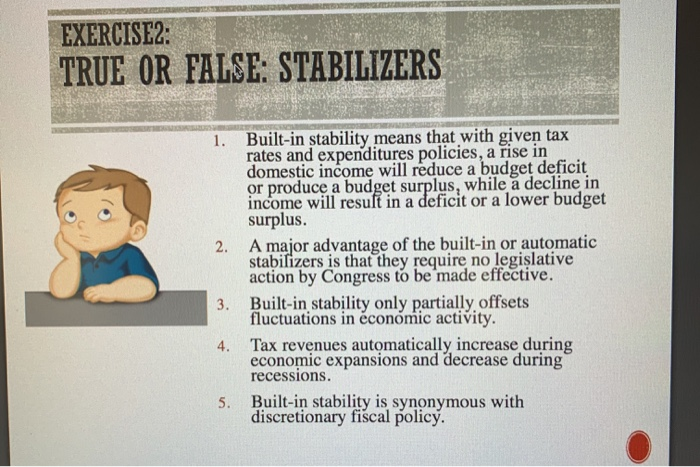

During a recession, automatic stabilizers can ease households’ financial stress by decreasing their tax bills or by boosting cash and in-kind benefits, all without changes in the tax code or any other new legislation. What are automatic stabilizers?Īutomatic stabilizers are mechanisms built into government budgets, without any vote from legislators, that increase spending or decrease taxes when the economy slows. So economists and others are looking towards expanding provisions in the law that automatically increase spending or reduce tax bills when the economy turns down.

But with political polarization in Washington, there is concern that Congress won’t move quickly enough to cut taxes or raise spending (known as discretionary fiscal policy) to buffer the effects of a crisis. Thus, the role of fiscal policy in economic stabilization is being viewed with increasing importance. With interest rates already very low, monetary policy may not be able to carry the entire burden of mitigating economic downturns.

0 kommentar(er)

0 kommentar(er)